A 5-year plan rebuild Black wealth and expand homeownership

By Charlene Crowell

Contributing Writer

While economists contend that the economic recession is over, the reality for much of Black America is starkly different. Racial disparities in unemployment and under-employment persist. And homeownership, a key measure of economic health for consumers and communities alike continues its downward decline even now.

According to the U.S. Census Bureau, during the last few months of 2015, 41.9 percent of Black households owned a home, compared to 72.2 percent of whites and 63.8 percent of all households across the country.

Many consumers and real estate professionals agree that redlining remains a serious problem. Despite federal and state laws guaranteeing fair housing and credit laws, majority-Black areas often do not have adequate access to credit.

Even worse, at a time when private mortgage interest rates have remained consistently low, very few Black borrowers have been able to benefit from these loans. The private market’s least costly convention mortgages have become out-of-reach for communities of color. In 2014, only 2.6 percent of owner-occupied conventional home purchases – approximately 45,500 nationwide – were made to Black borrowers. Other Census Bureau data show there are 9.9 million Black households, where 1.8 million people ages 25 and older hold a graduate degree.

Were it not for the array of government-backed mortgages – VA, FHA and USDA loans, homeownership rates for people of color would be even lower. In 2014, 68 percent of loans made to help Black borrowers purchase homes were backed by these federal programs.

In response to these disturbing findings, a five-year plan to add two million more Black homeowners has been launched by the National Association of Real Estate Brokers (NAREB). Founded in 1947 from a need to secure the right to equal housing opportunities regardless of race, creed or color, NAREB’s mission remains vital today.

“NAREB has taken the initiative to be in the vanguard to rebuild wealth in the Black community,” said Ron Cooper, NAREB’s president. “We are prepared to use every tool at our disposal … advocacy in the halls of Congress … expanding our army of informed and committed real estate professionals … engaging the active participation of informed organizational collaborators and lending partners …vigilance to the need to build and rebuild economic wealth through homeownership for Black Americans, regardless of the ‘issue of the day.’”

Beginning in February, NAREB has taken its message and advocacy to major cities facing severe housing challenges: Chicago, Memphis, Oakland and Philadelphia. By bringing NAREB’s message “closer to the ground”, respective Black communities were informed and engaged by more than 800 participating real estate professionals.

Those in attendance learned more about homeownership disparities in their own city, as well as the value and benefits of homeownership as a wealth-building tool. Each forum included housing counselors, legal and title experts, financial partners and other speakers that together explained what it takes to buy and own a home.

A second series of forums in four more cities is now being planned for 2017.

Progress towards the goal of two million more homeowners will be measured through a database management system that will track and capture sales activities across the country. Both NAREB members and participating lenders will have access to the system. Its data will augment findings from the annual Home Mortgage Disclosure Act (HMDA) report that tracks mortgage lending by race.

Commenting on NAREB’s efforts, Keith Corbett, an Executive Vice-President with the Center for Responsible Lending (CRL) and a NAREB partner noted, “When many Black families are paying $1,000 or more each month for rent, they are losing the chance to build wealth for their families. CRL views NAREB as a vital partner in advocating financial fairness for all.”

“The housing finance system must do a better job at providing mortgage credit to borrowers who represent the future,” added Corbett.

Earlier CRL mortgage research found that across the country from 2007 – 2011, foreclosures drained more than $2 trillion in property value, from families who live nearby foreclosed homes. More than half of these losses fell on either Black or Latino communities.

“Owning a home has been the way we’ve sent our children to school, financed our businesses, passed wealth on to our families, and kept our communities desirable places to live,” added NAREB’s Cooper. “The economic tsunami devastated our communities and halted our collective ability to be participants in and economically thriving members of this country’s greatest promise to its citizens: the dream of owning a home.”

For more information on NAREB, visit its website at http://www.nareb.com.

This article originally published in the May 2, 2016 print edition of The Louisiana Weekly newspaper.

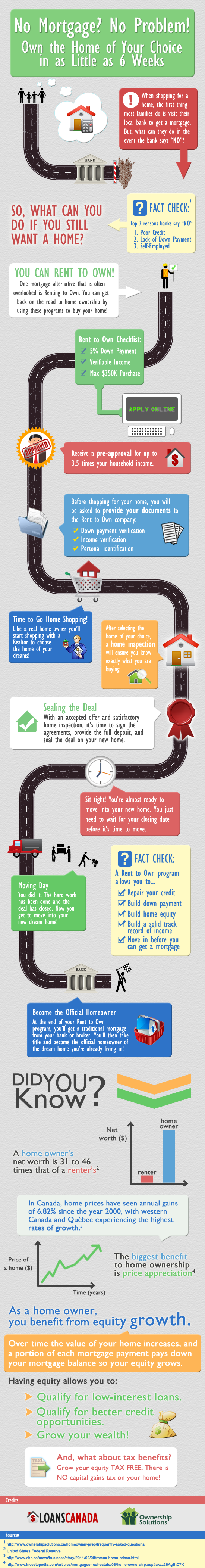

rent to own homes in new orleans

rent to own agreement

rent to own contract

free rent to own listings

rent to own real estate

rent to own realestate

rent to own houses

rent to own programs

rent to own condo

rent to own with bad credit

bond for deed

bond for deed in new orleans

rent to own in Metairie